About us

Sustainability reports

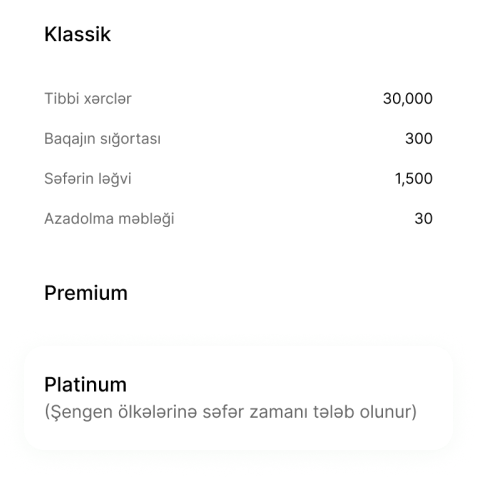

Charges and Fees

News

Procurement

Service network

Research

Investor Relations

Ways to protect from fraudsters