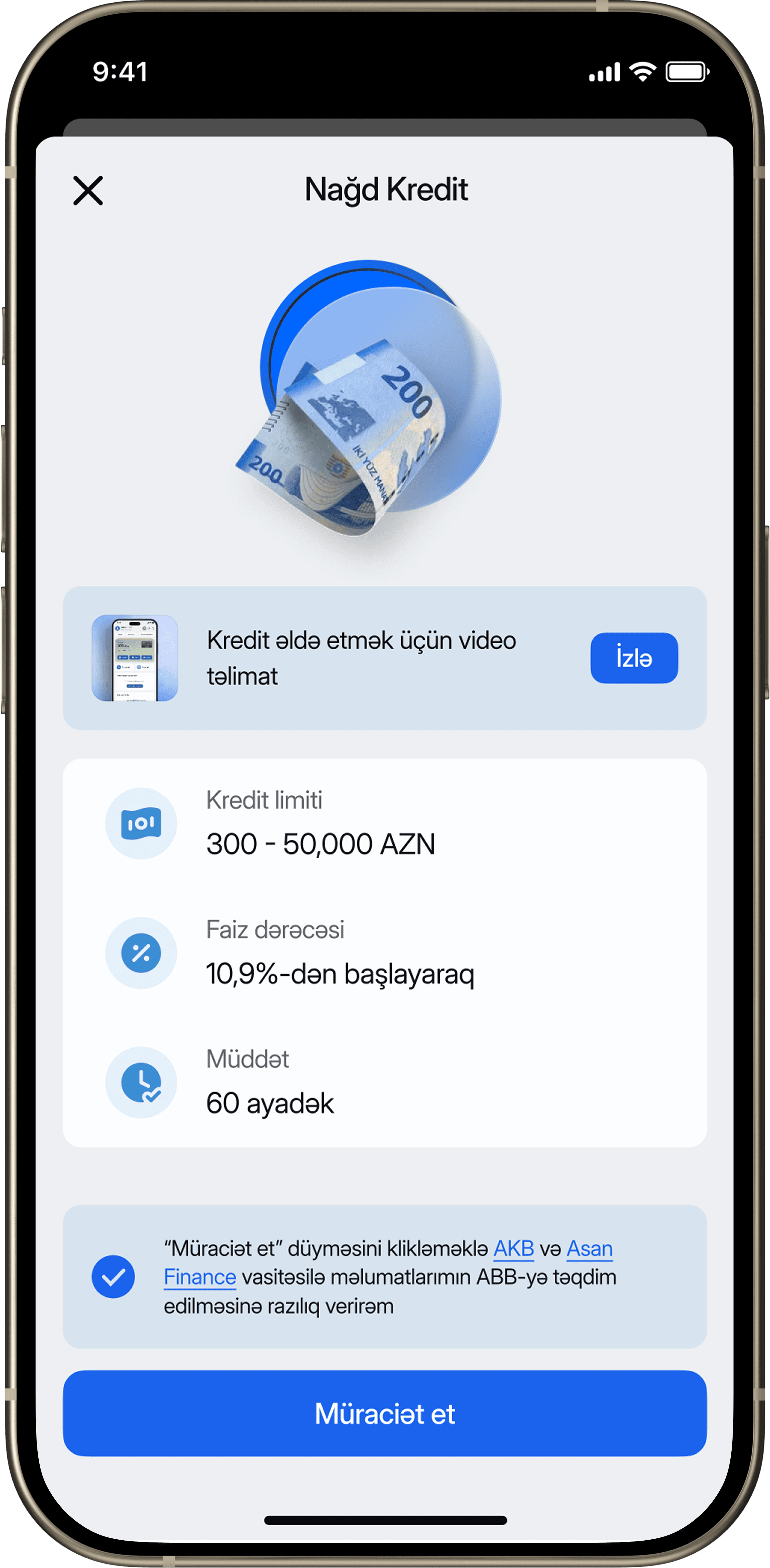

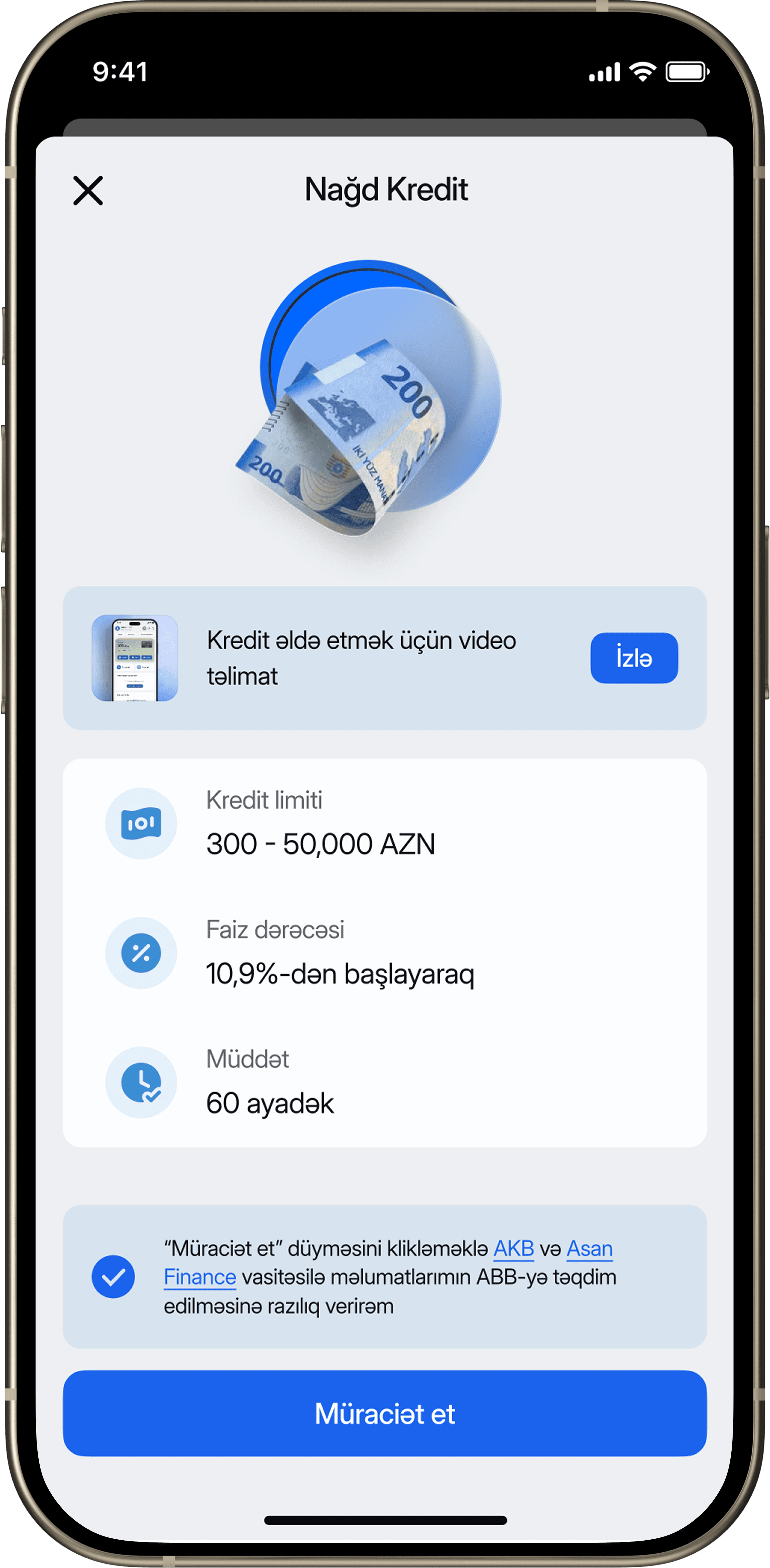

Online Cash Loan On Favorable Terms

Get a cash loan of up to 50,000 AZN without visiting the branch, from wherever you are! Order now, and have the amount transferred to your ABB card. APRC: min. 10.9% - max. 37.7%

Rate the page

Share your thoughts with us. Your feedback matters!

Get a cash loan of up to 50,000 AZN without visiting the branch, from wherever you are! Order now, and have the amount transferred to your ABB card. APRC: min. 10.9% - max. 37.7%

Advantages of a cash loan

Convenient loan terms

Get a cash loan of up to 50,000 AZN starting from 10.9% fully online and without a guarantor, without visiting a bank branch.

Fast loan processing

Get your cash loan instantly with fast online processing.

Installment card with no interest as a gift

When you obtain a cash loan, you will be granted a free installment card as a gift. This card allows you to make convenient, interest-free purchases for up to 24 months

Voluntary Credit Life Insurance

Get a discount on the annual interest rate by insuring your loan with credit life insurance.

Get a cash loan in 3 steps in ABB Mobile

What is your plan?

Traveling

Paying for airline tickets, hotel reservations, and living unforgettable adventures

Education

Covering tuition fees and course materials

Car

Car purchase, repairs and upgrades

Personal purchases

Buying furniture, electronics, or hosting special events

Apply for a loan online right now