Find your new home with ABB Home

Own the home of your dreams with Bank ABB’s affordable and reliable mortgage loans.

Rate the page

Share your thoughts with us. Your feedback matters!

Own the home of your dreams with Bank ABB’s affordable and reliable mortgage loans.

Advantages of our mortgage loans

Wide selection

Enjoy the opportunity to purchase apartments, private houses, and land plots in both new and old buildings with various types of mortgage loans.

Online application

Complete the mortgage process easily and online through the ABB Home platform.

TamKart Platinum gift

Customers who take an internal or state mortgage from Bank ABB receive a TamKart Platinum debit card free of charge. Enjoy additional benefits when shopping with the card.

Mortgage products

For apartments, private residences, and country houses

An internal mortgage loan offered for the purchase of apartments, country houses, and yard houses in new and old buildings for individuals with official income.

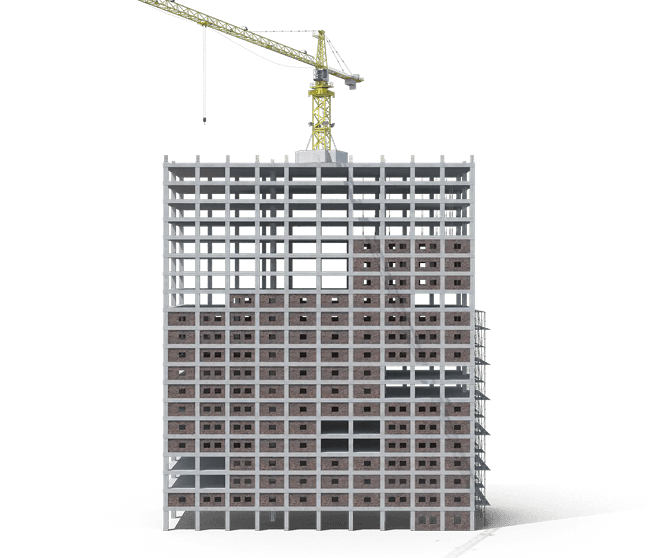

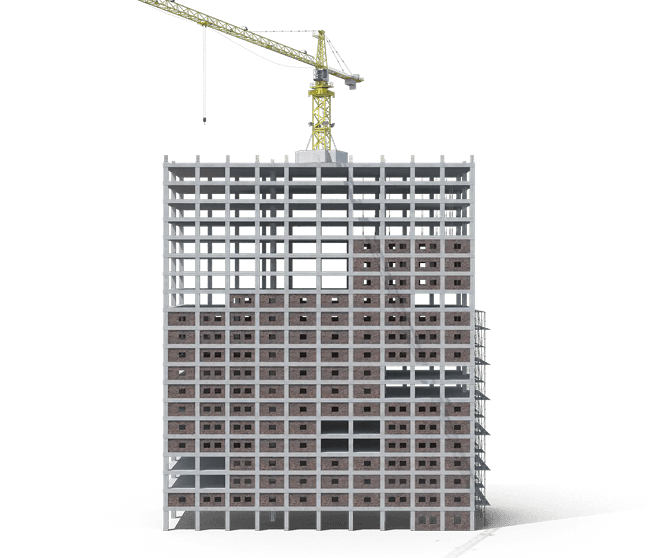

Through partner construction companies

An internal mortgage loan for the purchase of apartments and private houses without ownership certificates, owned by the Bank’s partner construction companies.

MIDA affordable mortgage loan

An affordable mortgage loan provided for the purchase of apartments owned by MIDA LLC and its partner investors.

State Mortgage

A mortgage loan provided from the funds of the Mortgage and Credit Guarantee Fund of the Republic of Azerbaijan (ARİKZF).

Renovation loan

A cash loan offered to individuals with official income, secured by real estate that has a title deed.

Secured consumer loan

A cash loan provided to finance renovation works in homes and apartments, secured by real estate.

Land mortgage loan

A mortgage loan intended for the purchase of land plots with title deeds designated for residential use.

Home construction mortgage loan

A mortgage loan provided for the construction of a private house on a land plot with a title deed and residential designation.

For apartments, private residences, and country houses

An internal mortgage loan offered for the purchase of apartments, country houses, and yard houses in new and old buildings for individuals with official income.

Through partner construction companies

An internal mortgage loan for the purchase of apartments and private houses without ownership certificates, owned by the Bank’s partner construction companies.

MIDA affordable mortgage loan

An affordable mortgage loan provided for the purchase of apartments owned by MIDA LLC and its partner investors.